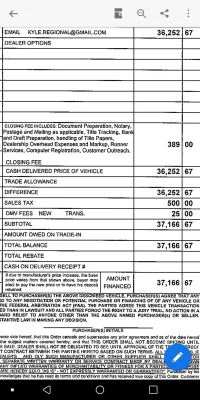

@SVT2003 That is better than I first thought. I thought the dealer really took you to the cleaners, but you did fine.

Your buyout will be the $41405 plus a $300 buyout fee and any sales tax for your state. You should definitley buyout ASAP to save on the high rent charges of the lease. Put down as much as you want on the credit union loan that you will get to perform the buyout. Obviously the more you put down, the less interest expense you will over the term of the loan.

The residual number does not mean anything if you are doing a buyout.

Your buyout will be the $41405 plus a $300 buyout fee and any sales tax for your state. You should definitley buyout ASAP to save on the high rent charges of the lease. Put down as much as you want on the credit union loan that you will get to perform the buyout. Obviously the more you put down, the less interest expense you will over the term of the loan.

The residual number does not mean anything if you are doing a buyout.